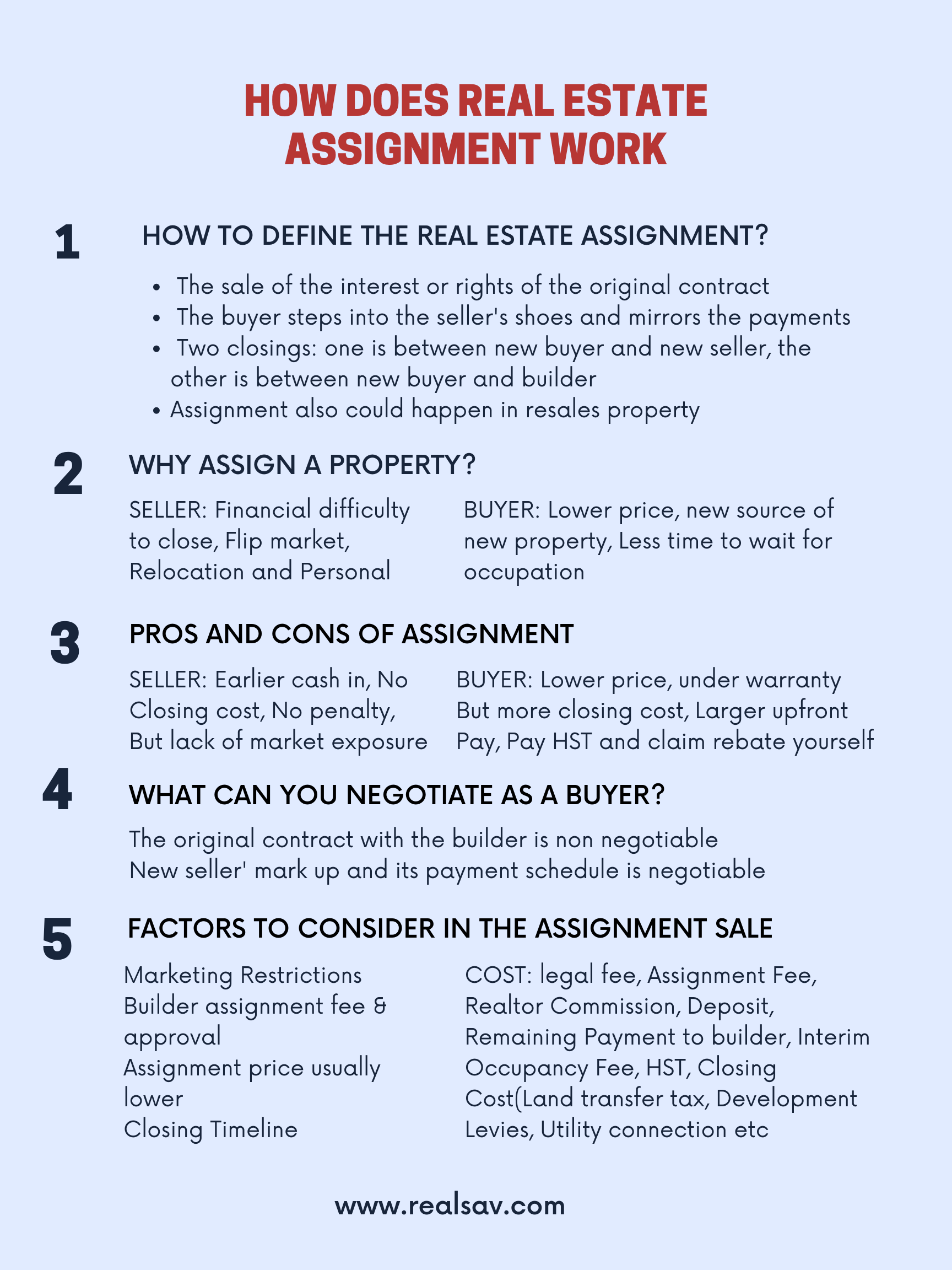

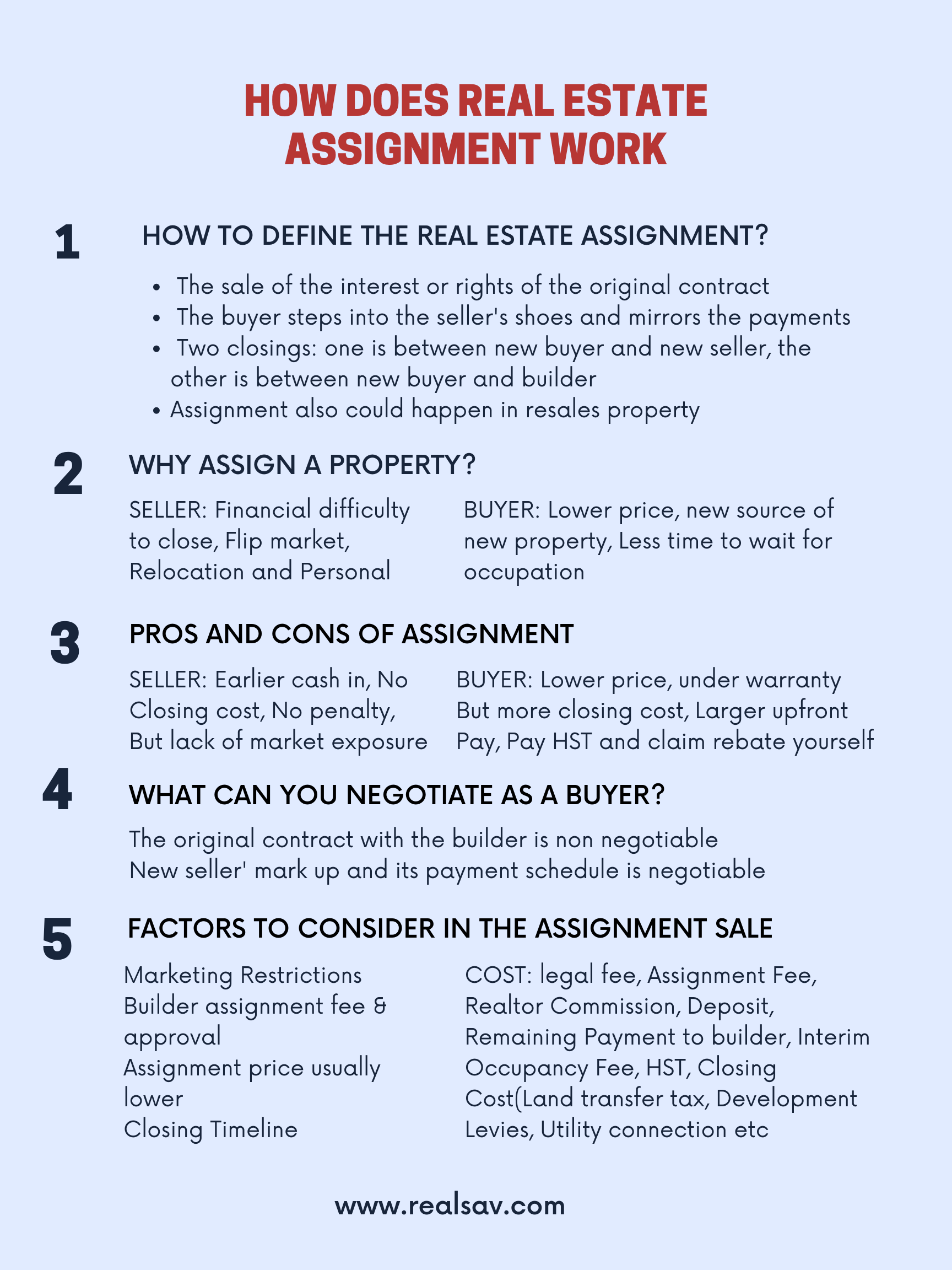

What is an Assignment Sale? How Does it Work?

What is an assignment sale?

An assignment sale in real estate, in essence, means the sale of the interest or rights of the original contract.

- The seller is called the assignor and the buyer is called the assignee.

- The assignment sale is very popular in the preconstruction condo market in Toronto and its surrounding cities such as Brampton, Oakville, Mississauga, Markham, and Vaughan in Ontario. Assignment Sales can also happen in the resale property.

- It means the right to purchase and the obligations in the contract between the assignor and the builder are transferred to the assignee.

- The assignee steps into the assignor’s shoes and mirrors the payments.

Therefore, for the assignee, the assignment would involve 2 closings. One is between the assignor and assignee, the other is between the assignee and the builder.

What is an assignment clause in real estate?

An assignment clause in real estate is one of the terms in the Agreement of Purchase and Sale with the builder, under which, the original buyer's obligations and rights under a contract are able to be assigned, or transferred, to another party.

How do assignment sales work?

From the assignor’s (the original buyer and new seller) perspective

- The actual property occupancy date is normally years away from the contract date with the builder.

- The original buyer may encounter financial difficulties, therefore can't pay off the balance. In this case, the buyer may have to pay high penalties from the builder, therefore it makes sense to carry out an assignment sale.

- The original buyer may have had no intention to close the deal from the start. They only want to flip the property.

- They may have personal reasons like relocation, family change or relationship change, etc.

From the assignee's (the new buyer) perspective

- The assignment is another avenue to source the new property.

- The assignment property is normally lower in price. But you do need to carefully calculate the overall cost.

- The assignee doesn’t need to wait very long before occupying the residence since most of the assignments happen during the interim occupancy period.

Pros and cons of assignment sales

To the assignor (original buyer)

- You can cash out earlier and move on.

- You don't need to pay the penalties.

- You don’t have to deal with closing and pay the land transfer taxes, HST, and other closing costs.

- However, it is hard to sell the assignment property due to marketing restrictions from the builder.

To the assignee (new buyer)

- You may own a new property at a lower than market price.

- The property is under the Tarion Warranty Program for defects and the new appliances are under warranty.

- However, the contract needs to be approved by the builder. The incentives and perks in the original contract may be impacted as well.

- You may have to pay a lot more closing costs that are not associated with a regular resale property. Those fees cost between 1% to 3% of the original sale price and include HST on appliances, Tarion fee, utility connection fee, and development levies. You are taking a risk if those fees are not capped in the original contract with the builder.

- You need to have a lot of cash ready to cover the deposits, the assignor’s profit, closing costs, etc.

- You may encounter property delays and changes that normally occur in pre-construction condos.

- You may not have the option of upgrades and finishes depending on the construction progress.

- You may have to pay HST and apply for the HST rebate later by yourself if qualified.

- The deal itself is more complicated and may accrue more legal fees.

What can you negotiate as a buyer?

- The price and terms of the original contract with the builder are non-negotiable.

- You also need to mirror the deposit that was already paid by the original buyer.

- The price of the new contract is negotiable, and the original buyer may want to make a profit on the sale.

- The payment schedule related to the increase in the price is negotiable as well.

Factors to consider in the assignment sale:

Marketing Restrictions

Though the builders allow for assignment sales, they commonly have marketing and advertising restrictions to protect their own property sales. For example, no MLS or online promotion is allowed.

A breach of contract may lead the contract to become void and the deposit to be confiscated. This may cause difficulty for the seller to find a buyer, but there are groups specializing in this type of business.

What is an assignment fee?

Builders also have restrictions regarding when and how you can sell your assignment. Builders have the final approval decision of assignment contracts and may charge an assignment fee. An assignment fee is generally a few thousand dollars but can be as high as 10 thousand dollars or more.

Why is the assignment property price usually lower?

Due to the builder’s marketing restrictions, the assignment property lacks exposure. It leads to lower numbers of potential buyers, the days on market become longer, and it is harder to estimate the market value due to a lack of comparable. All those factors above contribute to the lower price.

Who pays assignment fees?

The seller is obligated to pay the condo assignment fee per the builder contract, however, the fees most likely will be passed to the new buyer as a cost.

Cost of assignment sales

To seller

- The price of the assignment property is usually lower

- Higher legal fees due to the complexity

- Realtor commission

- Assignment fee

- The profit of assignment sales is taxable

To buyer

- When buying an assignment, the buyer needs to prepare a deposit at the same amount as what the seller has already paid to the builder

- The remaining cost to the builder

- Fees on Interim Occupancy if applicable, which roughly equals the total amount of monthly mortgage payment + condo fees + taxes

- Closing Costs, which is on average higher than a regular home sale

- Due to the complicated assignment process, the lawyer would charge higher for legal fees as well

Land Transfer Tax

Provincial Land Transfer Tax and municipal tax if applicable.

Development Levies

The development levies are variable and have been increasing significantly in recent years. It is a better practice to cap the development levies within the original contract with the builder.

TARION Fee

The TARION cost varies with the property price, hovering around $1900 for a $1M home.

Utility Connection Fee, etc.

In summary, the total closing fee on most pre construction condos may range around 5.5% of the original sale price.

HST

Builders may require the assignee to pay the HST and then the assignee applies for the HST rebate on their own after closing.

Closing Timeline

The assignment closing date: a few days after the builder’s approval.

Interim occupancy date: most assignments happen in the interim occupancy period of the pre-construction condo. The time that the condo is not fully completed and not registered yet, but the buyer could move in.

Closing date of the property: the title is registered and transferred to the new buyer.

What if the assignee doesn't close?

An assignor, most likely, is obliged to close the contract. Both assignor and assignee are liable.

In conclusion

Assignment sales are more complicated than regular residential home resales. As an assignee, you need to pay extra attention to the terms and clauses on both the original contract with the builder and the new contract with the seller. You need to be prepared for the 2 closings as well.