- Is a commission rebate legal in Ontario? →

- How much will I actually save? →

- When do I receive my rebate? →

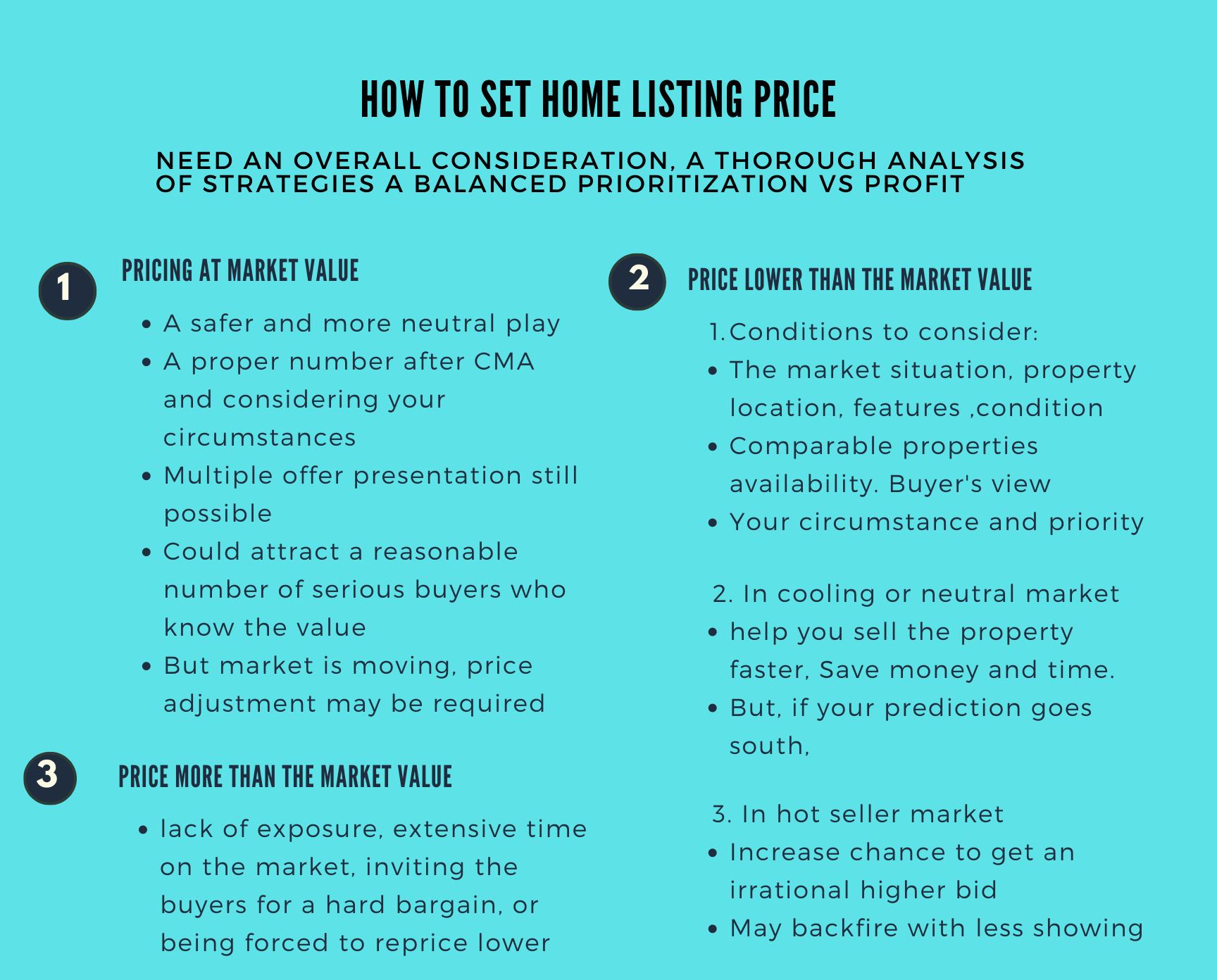

Setting up appropriate home selling prices is one of the crucial components of selling your property for an ideal price. An inappropriate pricing strategy may cause you to delay in time, more endeavor, and even money loss.

There are mainly 3 ways to price your property: price at market value, underpricing, and overpricing

Pricing at market value is a safer and more neutral play.

It basically goes with a first come first serve policy. However, you can still set an offer presentation date to have all the potential buyers competing with each other, which opens the channel for a buyer to pay over asking.

The benefit of pricing at market value is to generate a reasonable number of showings and to attract buyers who know the market and who are serious.

Depending on how fast the marketing is moving, your price may need adjustments to reflect the most recent comparable sales.

It is not uncommon to see that so many offers were presented on the bidding day and over hundreds of thousand dollars sold over asking for a property in the hot market.

However, it doesn't necessarily mean the underpricing strategy always works. Sometimes it backfires.

What is the market situation

What’s the property location, features, condition, and special reason to drive up the demand

How many competitive comparable properties are in the market?

How do your potential buyers view this pricing?

Your personal circumstance and priority

In the cooling market when the market is starting to decline or In a neutral market when the supply and demand are at equilibrium, setting up a lower price would stand you out and thus may attract comparatively more buyers and help you sell the property faster.

It eventually saves you money and time. However, if your prediction goes south, you leave more money on the table.

An overall consideration, a thorough analysis of those strategies, and a balanced prioritization vs profit are recommended on how to effectively price your home.

Our services include setting up a satisfactory listing price strategy at a marginal realtor fee