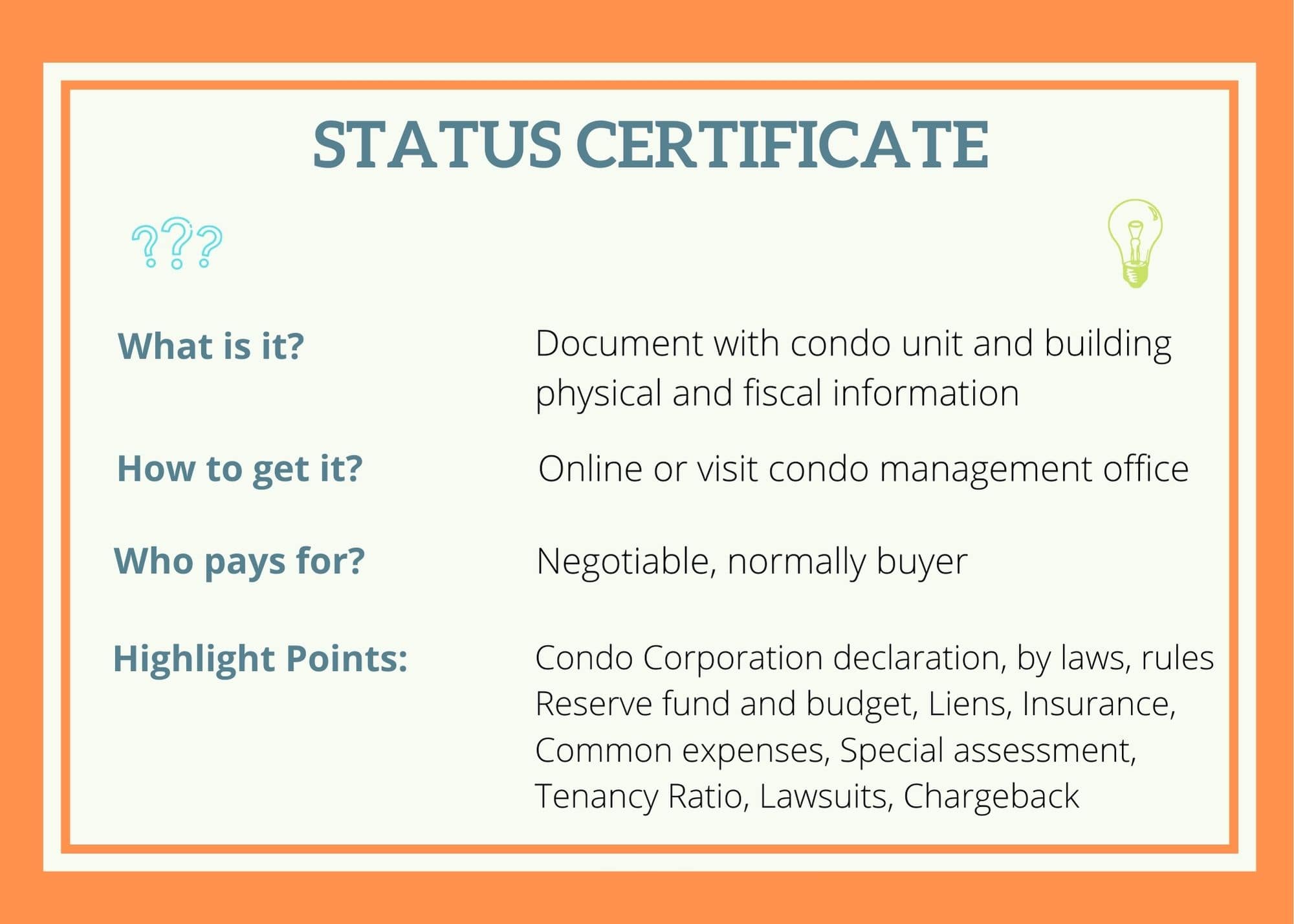

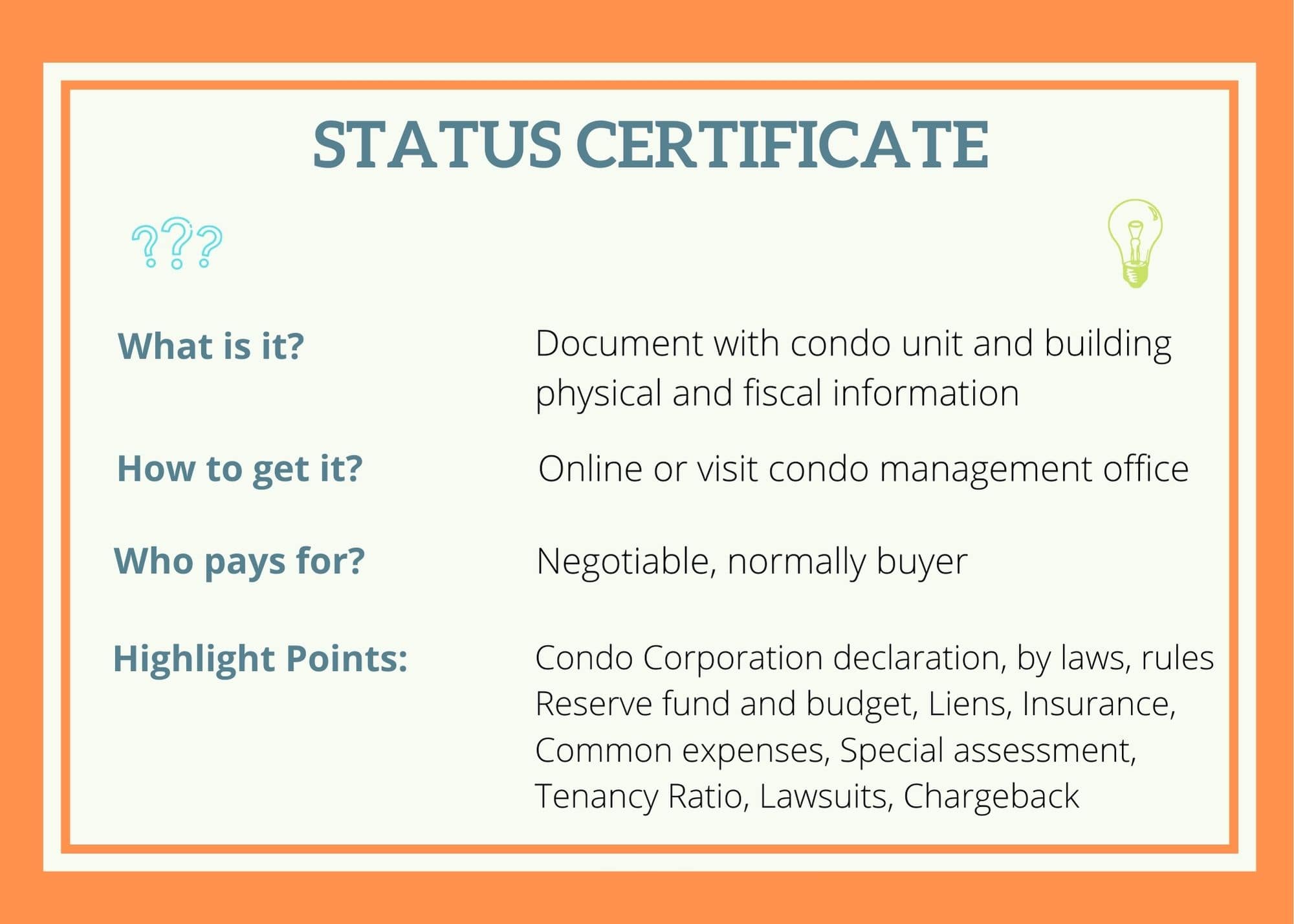

Condo Status Certificate: ALL You Need to Know

What is a Status Certificate?

- Status certificate in real estate is a critical document that condo buyers may need a lawyer to review.

- It covers the financial and legal health of the condo corporation. It includes important information on the unit such as maintenance fees, unit square foot, parking, locker, etc, and the common elements as well.

- The rules, bylaws, and user restrictions are also included such as pet restrictions, the limit on changes, etc.

Order Status Certificate

The Status of Certificate could be ordered online via the condominium management provider’s website, or in-person from the management company and the management office.

Status Certificate Cost

It is charged at $100 including tax and is available within 10 calendar days. There is an additional charge for expediency.

Status Certificate Condition

Who Pays for Status Certificate

- It is negotiable and depends on the situation. The certificate is usually ordered and paid by the buyer to the condo corporation.

- Sometimes, a seller may make it ready during the listing. So the buyer could get it reviewed in advance and then drop the status certificate condition in the offer.

How Long is it Valid for in Ontario

The certificate is no longer good if it's thirty days old in Ontario. If you couldn't have it reviewed on time, you may have to request a new one.

Lawyer Cost to Review Status Certificate

The seller normally would allow you 2~3 days to review the certificate depending on the contract. The Lawyer Cost to Review Status Certificate may be included in the whole package when you hire the lawyer for closing unless you have a separate deal specifically for the certificate. It ranges from $1000 to $1500 in total.

Highlights of Status Certificate

The status certificate runs over a hundred pages and some of the highlights are listed below.

Condo corporation’s current declaration, by-laws, and rules.

Reserve fund and budget

- A reserve fund is specifically used for major repair or replacement of common elements and assets.

- Adequate reserve funds and proper use are two key components.

- After the first reserve fund study, reserve fund studies are updated every three years.

- By reviewing the budget and reserve fund, your lawyer may give you some opinion on the condo's financial situation.

Common expenses

- Common expenses, also called condo fees or maintenance fees, are used to fund maintenance costs on the common elements, property management, insurance, and services such as garbage or snow removal, security, etc.

- Common expenses are calculated as a percentage that each unit owner contributes. The percentage may relate to the size of your unit.

Liens

The unit owner is obliged to pay common expense fees. In case of default, the condo corporation automatically has a lien on your unit.

Special Assessments

- A special assessment is an extra one-time charge added to your common expense fees.

- It is used for budget shortfalls and unforeseen major expenses such as repairs etc.

- Any current or planned special assessments will be outlined in the status certificate.

Insurance

The condo corporation is required to provide property and liability insurance to the common elements.

Chargeback

An addition to an owner’s condo fees to reimburse the condo corporation for a cost it incurred.

Lawsuits

The pending lawsuits may have an impact if it happens to be a legal loss without insurance coverage.

Tenancy Ratio

- A higher ratio of tenant-occupied condos may cause more wear, tear, and more degradation.

- It may appear less attractive when the unit is put on the market

- It may cause difficulty in mortgage obtaining.

In Sum

Status Certificate contains important information on the condo unit and the building, physically and fiscally. Reviewing status certificates can help you make an informed decision when you plan to buy a condo in Toronto.